Flood Damage and Insurance: Tips for Tampa Homeowners

Flooding is a real risk for Tampa homeowners, but many don’t realize their standard insurance won’t cover it. Flood insurance, usually through FEMA’s NFIP, is your best defense. Know what your policy covers, act fast during an emergency, and document everything when filing a claim. With the right preparation and knowledge, you can protect your property and your finances.

Why Flood Insurance Is Essential in Tampa

Tampa is no stranger to heavy rain, hurricanes, and storm surges. With so much water around, flooding can happen with little warning. Unfortunately, many homeowners don’t realize that most standard insurance policies do not cover flood damage.

Flood insurance is a separate policy designed specifically for water damage restoration caused by external sources like overflowing rivers, storm surges, and heavy rainfall. In a flood-prone area like Tampa, having this coverage is critical.

What Counts as Flood Damage?

Understanding the difference between flood damage and other types of water damage helps you avoid claim denial and rest easy knowing you have flood damage restoration coverage.

Flood damage refers to water that enters your home from the outside due to natural causes, like rising water from a storm or hurricane. Water damage, on the other hand, usually comes from internal issues, such as burst pipes, leaking appliances, or roof leaks. If rain comes through your ceiling due to a broken shingle, that’s usually covered under a typical policy. If water comes in through your front door during a flood, that’s when you need a dedicated flood insurance policy.

Knowing this distinction is key when filing a claim, as misclassification can delay or even void coverage.

Where to Get Flood Insurance in Florida

Many homeowners in Tampa’s water damage hotspots get flood insurance through the National Flood Insurance Program (NFIP), managed by FEMA. NFIP policies are sold by most insurance agents and cover both the structure of your home and its contents.

You can also explore private insurers, which may offer broader or more customizable coverage. These plans can be a good fit if your home’s value exceeds NFIP’s limits or you want additional protection.

Keep in mind: NFIP coverage doesn’t start immediately. There’s a 30-day waiting period, so it’s important to secure your policy well before the next storm season arrives.

What Flood Insurance Usually Covers

Flood insurance policies generally include two main types of coverage:

- Building Property: Covers the structure of your home, foundation, electrical systems, plumbing, built-in appliances, HVAC systems, and permanently installed carpeting.

- Personal Property: Covers belongings like furniture, clothing, electronics, and other movable items.

However, it typically does not cover:

- Temporary housing expenses

- Items stored in basements

- Landscaping, fences, and pools

Always read the fine print and clarify coverage with your agent to avoid surprises.

Tips for Filing Flood Damage Insurance Claims in Tampa

Flooding is stressful. Knowing how to act quickly and correctly makes the insurance process smoother.

If your home has standing water or exposed wiring, do not enter until you know it’s safe. Once it’s clear, begin documenting the damage. Use your phone to take high-resolution photos and videos of everything affected—walls, floors, furniture, and even soaked documents. This visual evidence is key to filing a strong claim.

Call your insurance company as soon as possible to start the claim. Most will send out an adjuster within a few days. In the meantime, keep a notebook or folder with all receipts, contacts, and updates. This documentation trail can prevent confusion later.

Avoid throwing out damaged items until your adjuster has seen them. If something must be removed due to health hazards, be sure to photograph it thoroughly before disposal.

What to Expect from the Insurance Process

Once your claim is filed, your insurer will walk you through next steps. Typically, you’ll:

- Meet with an adjuster to assess damage

- Receive a proof-of-loss form to complete

- Await an approval decision and payout based on your coverage limits

Be prepared to follow up. If something seems off with your estimate, ask questions. You can also appeal a decision or get help from a public adjuster if you think you’re being underpaid.

How to Protect Your Home from Future Flood Claims

Insurance is helpful, but the best plan includes prevention. Reducing your home’s flood risk can lower premiums, limit damage, and make recovery easier.

Start with basic maintenance. Keep gutters, downspouts, and drains free of debris. Grade your yard so water flows away from your foundation. Waterproof your basement if you have one. Elevate appliances and install flood vents to protect structural integrity.

It’s also worth having a professional assess your property for flood mitigation improvements. They might recommend sump pumps, backflow valves, or even elevating your HVAC system.

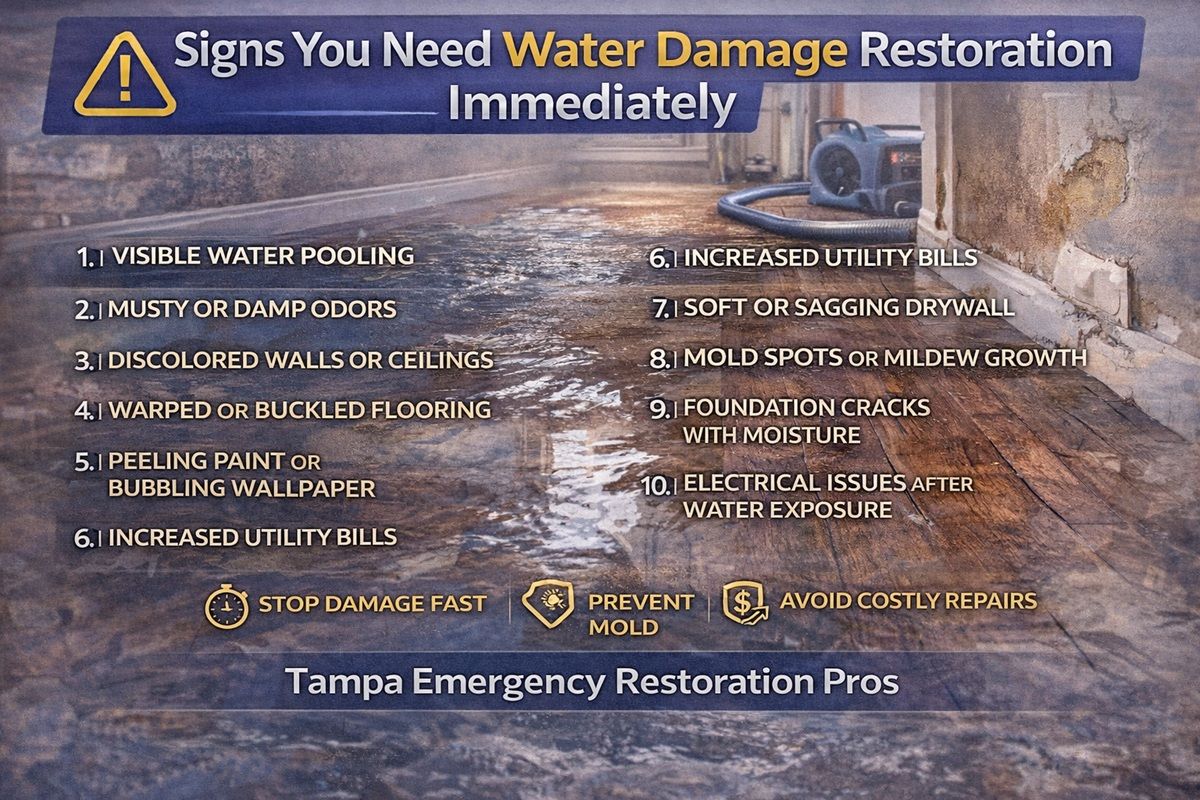

How Tampa Emergency Restoration Pros Can Help

When flood damage hits, time matters. Tampa Emergency Restoration Pros offers 24/7 emergency flood cleanup and can work directly with your insurance company. We assess damage, document loss, and help you recover as quickly as possible. Our local experience means we know how to handle Florida’s unique flood challenges.

Don’t wait until the next storm. Contact us today to learn how we can support you before, during, and after flood damage.

FAQs About Insurance for Flood Damage in Florida

Q: Does my homeowners insurance cover flood damage?

Homeowners insurance policies typically exclude flood damage, so you’ll need a separate flood insurance policy through the NFIP or a private insurer. Without that coverage, you’d pay out of pocket for any flood-related repairs. Check your current policy and consider adding flood insurance if you’re in a flood-prone area.

Q: Can I get flood insurance if I don’t live in a high-risk zone?

Yes—anyone can purchase flood insurance, regardless of their risk designation. Premiums are often lower in low-to-moderate risk areas, making coverage more affordable. Having a policy in place protects you financially against unexpected flooding.

Q: What should I do first after a flood?

First, ensure everyone’s safety and avoid entering flooded areas until it’s declared safe. Next, document the damage with photos or videos of your home and belongings. Finally, contact your insurance provider promptly to report the loss and start the claims process.

Q: How long do I have to file a flood insurance claim?

Under NFIP rules, you generally have 60 days from the date of loss to submit a proof-of-loss form. However, it’s best to begin the claims process immediately to secure documentation and avoid any missed deadlines. Reach out to your insurance agent right away to confirm specific requirements.

Q: Can I clean up before the adjuster arrives?

You may begin cleanup after you’ve thoroughly documented all damage with photos and videos. Once recorded, remove debris and make temporary repairs to prevent further harm. Keep receipts for any expenses, as these may be reimbursable under your policy.

Other Blogs You May Be Interested In

Categories